Saturday, June 30, 2012

Friday, June 29, 2012

Speaking of fine messes

As the ObamaTax kicks into high gear heading into its full implementation in '14, it doesn't take a Nostradamus to foretell the consequences. Indeed, some are already making themselves rudely obvious:

"The next year is one massive scramble for employers to implement the [ObamaTax] now that it’s been upheld, and not all the regulations businesses need to follow have been written."

Most of these will affect businesses with 50 or more employees (ouch!), which means a lot of small to mid-sized firms have to be thinking "why do I need this headache?"

Here in the Buckeye State, the[Evil] Mandate ObamaTax may cost north of "$940 million in 2014 and 2015 based on the 400,000 people in the state who are eligible for Medicaid but are not enrolled"

Of course, Gov Kasich could just go all Walker/Jindal here. Good times, good times.

Finally (well, for now):

"The [Deloitte Center for Health Solutions] is set to release a study that says the number of businesses offering coverage – 130 million – could be cut in half during the next decade"

Told. You. So.

"The next year is one massive scramble for employers to implement the [ObamaTax] now that it’s been upheld, and not all the regulations businesses need to follow have been written."

Most of these will affect businesses with 50 or more employees (ouch!), which means a lot of small to mid-sized firms have to be thinking "why do I need this headache?"

Here in the Buckeye State, the

Of course, Gov Kasich could just go all Walker/Jindal here. Good times, good times.

Finally (well, for now):

"The [Deloitte Center for Health Solutions] is set to release a study that says the number of businesses offering coverage – 130 million – could be cut in half during the next decade"

Told. You. So.

[Hat Tip: FoIB Holly R]

MedTech: VERY cool

That's the premise behind EmergencyLink, a free app and service accessible on your smartphone. You create a profile and contact list, and the service takes it from there.

Very cool.

But what if you just need some quick, helpful answers to a non-emergency qiestion? Well, that's where HealthTap comes in:

Like EmergencyLink, HealthTap can be accessed from your smartphone, but it also offers a web-portal for those of us with dumb ones. The service even lets you exchange files for more in-depth conversations with its 12,000+ physicians.

No word yet on how many of them make housecalls.

Time to get to work

Now that ObamaCare is here to stay, for now, the real work begins. How do we make the best of the situation and minimize the damage?

Tens of Thousands if not hundreds of thousands of mostly small employers self fund under a high deductible that will be going away in 2 years or less. This model has been extremely effective, save 15% on your auto insurance in 15 minutes comes to mind. Employers can offer the same benefits just 10-20% cheaper. It also has brought the expertise of true professionals onto the issues of excessive provider reimbursement, inefficient care, and cost control. Ten thousand engaged brokers and TPAs will deliver far better results then 500 politicians and 100 Academic quacks any day. This model is counter to the principals of ACA which is looking for high premiums and top down cost control. It is going to take some major efforts and lots of luck for these plans to survive. Small employers need to be prepared for not only a 10-20% increase when high deductible plans go away but a 30-50% increase when their new low deductible plan is community rated. If your in Ohio and rated 1-36 in small group everyone under 20 better be prepared. If your under 10 I don't think a 3 digit rate increase is out of the realm of possibility.

The people that think professionally are strong believers that a $100 tax, penalty, tax is going to prevent adverse selection. 30+ years of reality says it will just make the issue worse. Employers are going to have to find an affordable plan they can pay 100% of the employee cost for to maintain participation. Prepaid plans sponsored by a local health system might be back in vogue pretty quickly. Choice will be the first casualty of ACA.

Tax rates will be the second, when this doesn't work, reform always fails to do what reform says it will, the logical thing to do would be to scrap it, just like Medicare they will borrow to cover it instead. Eventually we will hit our credit limit and when we do taxes will skyrocket. If you can't stomach health insurance as a career any longer accounting and financial planning are going to be very busy.

Finally the practice of medicine is about to get considerably more altruistic. You would think providers learned their lesson after getting suckered on Medicare. This time they are not getting flowers and dinner first. 80-85% of spending goes to providers, when the budget is busted that is going to stick out like a cancer for the scalpel.

The one positive I see is every time government has tried to fix healthcare they have made a complete mess of things and created entire new industries to address it. There is going to be a whole lot of fixing to be done and thus a whole lot of work for those that identify it.

Tens of Thousands if not hundreds of thousands of mostly small employers self fund under a high deductible that will be going away in 2 years or less. This model has been extremely effective, save 15% on your auto insurance in 15 minutes comes to mind. Employers can offer the same benefits just 10-20% cheaper. It also has brought the expertise of true professionals onto the issues of excessive provider reimbursement, inefficient care, and cost control. Ten thousand engaged brokers and TPAs will deliver far better results then 500 politicians and 100 Academic quacks any day. This model is counter to the principals of ACA which is looking for high premiums and top down cost control. It is going to take some major efforts and lots of luck for these plans to survive. Small employers need to be prepared for not only a 10-20% increase when high deductible plans go away but a 30-50% increase when their new low deductible plan is community rated. If your in Ohio and rated 1-36 in small group everyone under 20 better be prepared. If your under 10 I don't think a 3 digit rate increase is out of the realm of possibility.

The people that think professionally are strong believers that a $100

Tax rates will be the second, when this doesn't work, reform always fails to do what reform says it will, the logical thing to do would be to scrap it, just like Medicare they will borrow to cover it instead. Eventually we will hit our credit limit and when we do taxes will skyrocket. If you can't stomach health insurance as a career any longer accounting and financial planning are going to be very busy.

Finally the practice of medicine is about to get considerably more altruistic. You would think providers learned their lesson after getting suckered on Medicare. This time they are not getting flowers and dinner first. 80-85% of spending goes to providers, when the budget is busted that is going to stick out like a cancer for the scalpel.

The one positive I see is every time government has tried to fix healthcare they have made a complete mess of things and created entire new industries to address it. There is going to be a whole lot of fixing to be done and thus a whole lot of work for those that identify it.

The 50th Employee

Lost amid the shuffle of yesterday's ObamaTax ruling is the Employer Mandate. Way that works is, if you employ more than 49 people, you've either got to offer (and help pay for) a group plan or pay a penalty tax. For most employers this will be a no-brainer: the penalty tax will be much lower than the insurance premium.

Here's the problem: if you currently employ 49 people, you're not going to be hiring that 50th guy, because that would cancel your exemption. Which means your current workforce is either going to have to work harder (to make up for that missing 50th employee), or you're going to need to scale back even further.

And if you're the 50th employee right now, you'd best be updating your resume.

Here's the problem: if you currently employ 49 people, you're not going to be hiring that 50th guy, because that would cancel your exemption. Which means your current workforce is either going to have to work harder (to make up for that missing 50th employee), or you're going to need to scale back even further.

And if you're the 50th employee right now, you'd best be updating your resume.

HWR Supplemental: SCOTUS rules edition [UPDATED]

Health Wonk Review co-founder Joe Paduda hosts a special edition highlighting blggers' reactions to yesterday's ObamaTax decision. Pro or con, there's some great analysis all conveniently available - check it out.

UPDATE (7/2/12): Joe's now posted a second part to this Special Edition. Kudos!

UPDATE (7/2/12): Joe's now posted a second part to this Special Edition. Kudos!

Thursday, June 28, 2012

ObamaTax: A Silver Lining

Now that SCOTUS has affirmed that we must pay higher taxes, while placing our health care in the hands of unelected and unaccountable Death Panels, it's helpful to know that there are alternatives.

Since we'll now be seeing fewer medical innovations, what can folks do if (when?) they need health care and can no longer find it (or are denied outright)?

Well, the folks at Medical Travel Today report that "[s]afety is and has always been a key issue in the world of healthcare and medical travel ... one organization is doing its part to bring a new level of safety to many medical travelers' first step: the search."

MTT has an exclusive interview with DotHealth CEO Andy Weissberg; DotHealth "aims to create a safer, more secure environment for both consumers and global health stakeholders from a variety of fields."

Those of us with Health Savings Accounts (HSA's) will also be interested in this item, which reports that "HSA account holders will now have the opportunity to take advantage of a medical travel option and access high quality healthcare services at significant savings virtually anywhere in the world."

Of course, HSA-compliant plans will be phased out as ObamaTax is fully implemented, and it's unclear how the accounts themselves will fare down the road. But for now, it's up, up and away!

SCOTUS Postmortem

SCOTUS has spoken on Obamacare. What follows is a series of links and excerpts on today's news.

First, the 193 page opinion from the Court.

It's not a mandate if it is a tax.

Potential impact on the fall elections.

What does this mean for you?

Erick Erickson's initial shot across the bow. If you are opposed to Obamacare, read this VERY carefully.

If you share Erick's views, today's SCOTUS opinion may have just opened the door for eliminating Obamacare this fall.

First, the 193 page opinion from the Court.

It's not a mandate if it is a tax.

Potential impact on the fall elections.

What does this mean for you?

Erick Erickson's initial shot across the bow. If you are opposed to Obamacare, read this VERY carefully.

If you share Erick's views, today's SCOTUS opinion may have just opened the door for eliminating Obamacare this fall.

Wednesday, June 27, 2012

Read My Lips

PLENTY of new taxes.

PLENTY of new taxes.The folks at American's for Tax Reform have this to say about Obamacare and SCOTUS.

On the eve of the Supreme Court’s decision on Obamacare, taxpayers are reminded that the President’s healthcare law is one of the largest tax increases in American history.

Obamacare contains 20 new or higher taxes on American families and small businesses. On Thursday, Americans for Tax Reform will do a full analysis of the tax implications of the Court’s decision.

Arranged by their respective effective dates, below is the total list of all $500 billion-plus in tax hikes (over the next ten years) in Obamacare, where to find them in the bill, and how much your taxes are scheduled to go up as of todayClick here for the rest of the story...

So the question is, if Obamacare is repealed, either by SCOTUS or next year's president/congress, what happens to ALL THOSE TAXES?

Something else to ponder...

Although we've had an unofficial moratorium on predicting tomorrow's SCOTUS decision re: ObamneyCare©, it's worth noting that the [Evil] Individual Mandate and the Exchanges aren't the only issues to be decided:

" [T]here are some major health-insurance regulations besides community rating and guaranteed issue ... Medicaid expansion"

Although the CornHusker "dodge" was withdrawn, the very real financial (and legal) issues that accrue to the expansion (at state cost!) to Medicaid are very real.

Money is money.

" [T]here are some major health-insurance regulations besides community rating and guaranteed issue ... Medicaid expansion"

Although the CornHusker "dodge" was withdrawn, the very real financial (and legal) issues that accrue to the expansion (at state cost!) to Medicaid are very real.

Money is money.

The Height of Ineptitude

On the eve of the Obamacare decision from the Supreme Court, it is both interesting and disturbing, to read some of the chatter both from the health care and health insurance industry and from the outside. What is remarkable to me is how many people that SHOULD understand the ramifications of Obamacare clearly illustrate how inept they are at their own game.

This just in from Life Health Pro where state insurance regulators offered their view at a press conference.

Price controls don't work. We don't have to look too far back in our history to see what happened when the federal government imposed controls on gasoline. The long lines and rationing of gasoline didn't go over very well.

The same will be true with the government controlling the cost of health care, or health insurance for that matter.

So how about a voucher system, where the government issues chits that can be used (by some) to purchase health insurance?

All you need do is look at the food stamp program where 44 million people use taxpayer dollars to pay for their food, and in some cases, alcohol, tobacco, lottery tickets . . .

Health care costs rise primarily because of excessive demand and little financial pain to those with insurance. Something on the order of 88% of health care bills are paid for by third parties (health insurance, Medicare, Medicaid) leaving only a very small portion to be paid by the consumer.

If consumers paid more for the direct cost of health care they might assume healthier lifestyles rather than seeking a drug to alleviate the symptoms of an illness.

The insurance exchanges, a kind of Amazon for health insurance, is one of the precepts of Obamacare. States are required to establish their own exchange, and if they don't, the feds will do it for them.

Oh, and here is a clue.

Although Amazon has grown to be much more than just a book store you need to be reminded that there are still some folks that like to stroll through Barnes and Noble and leisurely read a book while sipping a latte and really don't care for buying online.

Health insurance isn't any different.

Whatever those folks were smoking, I want some of it.

Obamacare is built on a foundation of fantasy and lies.

As the economy has struggled to recover (in spite of the meddling by DC rocket surgeons) there is one common thread that is perplexing to those who do not understand commerce.

While some businesses have failed, and others have downsized, most every business that has survived has remained profitable. Some are even investing in new equipment . . . . but few are hiring. When they do hire, the jobs go to part time employees, independent contractors or workers outside of the country.

The combination of excessive government oversight, possibility of higher taxes and the unknown costs associated with Obamacare have caused the job market to languish.

Will employers start to hire if Obamacare is de-fanged or gutted and hung on a tree to die?

Some will, some won't.

No doubt the total elimination of Obamacare will be a shot in the arm for employment and the economy, but to return to REAL growth there needs to be a new mindset in Washington with regard to private industry. As scary as that is, I think 75% is a very conservative number.

This just in from Life Health Pro where state insurance regulators offered their view at a press conference.

how states can muscle past a possible rejection by the Supreme Court of the individual mandate under health care reform, yet still have state health exchanges remain viable. What no one at the event could figure out was how to contain health insurance costs without more Congressional fixes if the exchange ever came to be.You would think by now they would have figured out there really is no way for anyone to control health care costs short of nationalizing the industry and setting the value of health care by fiat.

Price controls don't work. We don't have to look too far back in our history to see what happened when the federal government imposed controls on gasoline. The long lines and rationing of gasoline didn't go over very well.

The same will be true with the government controlling the cost of health care, or health insurance for that matter.

So how about a voucher system, where the government issues chits that can be used (by some) to purchase health insurance?

All you need do is look at the food stamp program where 44 million people use taxpayer dollars to pay for their food, and in some cases, alcohol, tobacco, lottery tickets . . .

Health care costs rise primarily because of excessive demand and little financial pain to those with insurance. Something on the order of 88% of health care bills are paid for by third parties (health insurance, Medicare, Medicaid) leaving only a very small portion to be paid by the consumer.

If consumers paid more for the direct cost of health care they might assume healthier lifestyles rather than seeking a drug to alleviate the symptoms of an illness.

The insurance exchanges, a kind of Amazon for health insurance, is one of the precepts of Obamacare. States are required to establish their own exchange, and if they don't, the feds will do it for them.

Oh, and here is a clue.

Although Amazon has grown to be much more than just a book store you need to be reminded that there are still some folks that like to stroll through Barnes and Noble and leisurely read a book while sipping a latte and really don't care for buying online.

Health insurance isn't any different.

If the federal government takes over the exchanges, which must be self-sustaining after a period of time, other questions remain. Among them: Where will the money will come from? Who will collect the funds? And by what method?Obamacare was a law that was not only pieced together like sausage with parts from head to tail of the pig, but was conceived and sold to the public on the promise that it would not only make health care (and health insurance) more affordable but would actually reign in the federal deficit.

Whatever those folks were smoking, I want some of it.

Obamacare is built on a foundation of fantasy and lies.

Adam Hamm, vice present of the National Association of Insurance Commissioners (NAIC), told reporters at the press conference that while NAIC Health Insurance (B) Committee Chairperson Sandy Praeger took a glass half-full approach to a mandate-less health reform law, there were a “number of us with grave concerns” related to enormous pressure to increase rates starting as soon as 2013.I've got news for you. Even WITH the mandate in place the cost of health insurance will skyrocket. It will only get worse when you can wait until you are really sick to purchase health insurance.

Hamm, the Republican North Dakota insurance commissioner (who is up for re-election this year) compared a striking down of the mandate, to pulling a pin on a hand grenade and putting the grenade in the lap of the American people. Hamm also echoed the Administration’s argument that the mandate and requiring insurers to take all comers are interconnected. He noted also that a dangling guaranteed issue, unmoored from the individual mandate, would not work due to skyrocketing costs.

Actuaries will be crunching the numbers as soon as the High Court delivers its opinion—expected Thursday—and rate insurance requests will pour in, Hamm said. He added he is seeing rate increases in the individual market spike by 75% to 100% from one provider, and by 15% to 20% in the group market, both spikes on top of normal rate increases under current law. These numbers are going to be “much more if the individual mandate goes,” Hamm said.Beyond what happens tomorrow, and the ensuing impact on health insurance, there are other things tied to Obamacare that impact most of us.

As the economy has struggled to recover (in spite of the meddling by DC rocket surgeons) there is one common thread that is perplexing to those who do not understand commerce.

While some businesses have failed, and others have downsized, most every business that has survived has remained profitable. Some are even investing in new equipment . . . . but few are hiring. When they do hire, the jobs go to part time employees, independent contractors or workers outside of the country.

The combination of excessive government oversight, possibility of higher taxes and the unknown costs associated with Obamacare have caused the job market to languish.

Will employers start to hire if Obamacare is de-fanged or gutted and hung on a tree to die?

Some will, some won't.

No doubt the total elimination of Obamacare will be a shot in the arm for employment and the economy, but to return to REAL growth there needs to be a new mindset in Washington with regard to private industry. As scary as that is, I think 75% is a very conservative number.

Cavalcade of Risk #160: Wildfire Edition

Louise Norris hosts this week's smokin' hot edition of the Cavalcade of Risk. Come for Money Mustaches, stay for the Financial Cents. But do stop by.

24 Hours and Counting

Tuesday, June 26, 2012

More Stupidity from Ezra [UPDATED]

Alleged health blogger Ezra Klein, noted rocket surgeon extraordinaire, continues to double down on the stupid. Today he opines that even the Father of Our Country liked him some mandates. As reported on Twitter:

"In 1798, Congress mandated that sailors buy health insurance. John Adams signed it into law."

The twit (tweet?) directs the unwitting to Ezra's latest contrivance, wherein he demonstrates profound difficulty discerning the difference between forcing all citizens to purchase a product as a condition of citizenship and specifying that certain individuals must buy a product in order to serve in the military.

Seems pretty clear to me.

In order to show that he really doesn't get it, Ezzie doubles down by citing a 1790 Congressional mandate that "ship owners buy medical insurance for their seamen." Perhaps noticing that there's a pretty glaring logical fallacy here [ed: is there any other kind with this guy?], he observes that "in 1798, Congress ... enacted a federal law requiring the seamen to buy hospital insurance for themselves."

Again, one can choose whether or not to be a sailor. But the [Evil] Individual Mandate applies to all citizens (well, almost all). How come you don't talk about those exceptions, Ezra?

[Hat Tip: FoIB Holly R]

UPDATE/IRONY ALERT: I can't believe I missed this before posting. Ezra Klein relies on legislation from the 18th Century to make his "point?" Is this the same Ezra Klein that pooh-poohs the Constitution because it's "not a clear document. Written 100 years ago, when America had thirteen states and very different problems, it rarely speaks directly to the questions we ask it?"

Why yes, yes it is.

The stupid burns strong in that one.

"In 1798, Congress mandated that sailors buy health insurance. John Adams signed it into law."

The twit (tweet?) directs the unwitting to Ezra's latest contrivance, wherein he demonstrates profound difficulty discerning the difference between forcing all citizens to purchase a product as a condition of citizenship and specifying that certain individuals must buy a product in order to serve in the military.

Seems pretty clear to me.

In order to show that he really doesn't get it, Ezzie doubles down by citing a 1790 Congressional mandate that "ship owners buy medical insurance for their seamen." Perhaps noticing that there's a pretty glaring logical fallacy here [ed: is there any other kind with this guy?], he observes that "in 1798, Congress ... enacted a federal law requiring the seamen to buy hospital insurance for themselves."

Again, one can choose whether or not to be a sailor. But the [Evil] Individual Mandate applies to all citizens (well, almost all). How come you don't talk about those exceptions, Ezra?

[Hat Tip: FoIB Holly R]

UPDATE/IRONY ALERT: I can't believe I missed this before posting. Ezra Klein relies on legislation from the 18th Century to make his "point?" Is this the same Ezra Klein that pooh-poohs the Constitution because it's "not a clear document. Written 100 years ago, when America had thirteen states and very different problems, it rarely speaks directly to the questions we ask it?"

Why yes, yes it is.

The stupid burns strong in that one.

PCIP Abuse

PCIP is one of the few things in Obamacare that I support, even AFTER the government decided they would stop paying insurance agents a finders fee.

I seriously doubt the bozo's in DC considered how easily their plan could be manipulated. Consider this posting by an insurance agent in an industry forum.

I recently spoke with a friend that doesn't have any coverage. She needs major back surgery quick. They met with the hospital and projected charges are 150,000. The billing department suggested buying the PCIP plan, paying a few months premium, and then if they can't afford the premium to drop the coverage, everything gets paid for pennies on the dollar. Seems the hospital is encouraging this ploy. Wonder how often this is being done?

Every day, Ned.

Every day.

There are also agents that field calls from women who are pregnant and need health insurance. Care to guess where they are referred?

Yup.

PCIP.

I seriously doubt the bozo's in DC considered how easily their plan could be manipulated. Consider this posting by an insurance agent in an industry forum.

I recently spoke with a friend that doesn't have any coverage. She needs major back surgery quick. They met with the hospital and projected charges are 150,000. The billing department suggested buying the PCIP plan, paying a few months premium, and then if they can't afford the premium to drop the coverage, everything gets paid for pennies on the dollar. Seems the hospital is encouraging this ploy. Wonder how often this is being done?

Every day, Ned.

Every day.

There are also agents that field calls from women who are pregnant and need health insurance. Care to guess where they are referred?

Yup.

PCIP.

God bless Obama.

So, are you a Hep Cat?

FoIB Jeff M alerts us to this disturbing news for the Boomers among us:

"A government proposal that all baby boomers get tested for hepatitis C may be drawing high praise for its potential health benefits, but it’s also raising questions about the unintended consequences of screening for those seeking insurance."

We see this a lot: doc's prescribing tests and/or med's for conditions that may (or, you know, may not) exist, which then show up in the medical records of folks seeking insurance. I recently spoke with a Long Term Care insurance prospect whose physician had prescribed a particular med for her anxiety; this has caused her some grief in the application process.

The Hep C issue is, I must admit, news to me. On the one hand, it was a routine blood exam for a life insurance policy that turned up HIV in a famous professinal athlete. On the other, well:

"Even treatment for hepatitis C might not guarantee acceptance since current protocols may not be 100 percent effective."

I do have a problem with this:

"I would never, ever tell anybody to delay getting any kind of medical exam ... But you have an advantage over the insurance company if you apply for insurance before undergoing any kind of medical checkups.”

Ooops.

Here's the problem: life and health applications ask not just whether you've seen a doc recently, but whether or not you've experienced any "issues" which might be a clue that you do so. Long Term Care apps are especially stringent on these points. And although carriers routinely act stupidly, they're not run by stupid people.

"A government proposal that all baby boomers get tested for hepatitis C may be drawing high praise for its potential health benefits, but it’s also raising questions about the unintended consequences of screening for those seeking insurance."

We see this a lot: doc's prescribing tests and/or med's for conditions that may (or, you know, may not) exist, which then show up in the medical records of folks seeking insurance. I recently spoke with a Long Term Care insurance prospect whose physician had prescribed a particular med for her anxiety; this has caused her some grief in the application process.

The Hep C issue is, I must admit, news to me. On the one hand, it was a routine blood exam for a life insurance policy that turned up HIV in a famous professinal athlete. On the other, well:

"Even treatment for hepatitis C might not guarantee acceptance since current protocols may not be 100 percent effective."

I do have a problem with this:

"I would never, ever tell anybody to delay getting any kind of medical exam ... But you have an advantage over the insurance company if you apply for insurance before undergoing any kind of medical checkups.”

Ooops.

Here's the problem: life and health applications ask not just whether you've seen a doc recently, but whether or not you've experienced any "issues" which might be a clue that you do so. Long Term Care apps are especially stringent on these points. And although carriers routinely act stupidly, they're not run by stupid people.

Monday, June 25, 2012

Hoosier Healthcare Hijinx

We last discussed the Healthy Indiana program almost 4 years go. At the time, we noted that low income Hoosiers were eligible for Health Savings Account (HSA) plans. Even then, preventive benefits were available with little or no out-of-pocket. The major downside seemed to be the $300k lifetime cap on all covered expenses.

Well, a few years later and along comes ObamneyCare©, and the most vulnerable of Hoosiers can kiss their Healthy Indiana coverage goodbye:

Well, a few years later and along comes ObamneyCare©, and the most vulnerable of Hoosiers can kiss their Healthy Indiana coverage goodbye:

[Hat Tip: FoIB Bob D]

Ill-advised Citizen Tricks

FoIB Patrick P sent us this item:

"I canceled my very expensive individual health insurance coverage through California's state-run high-risk plan and became insurance-free ... no one will insure me on the individual market ... I have made do with the state's high-risk insurance plan. California ... The federal high-risk plan would cost me just $265 a month"

It's hard not to feel some compassion for Randy Dotinga (Mr D): his health issues don't seem to be self-inflicted. But I have a number of issues with what he proposes. Of course, I completely respect his right to make this choice, even if ill-advised.

University of Chicago professor Harold Pollack nails it:

"[Randy's] responding in an understandable way ... Any program that requires people to be actively uninsured creates a very paradoxical and painful set of incentives and encourages people to do what you're doing."

As we've noted before, PCIP requirements are not only counter-intuitive, they actually punish folks who've played by the rules (as Mr D appears to have done). In this case, he's taking a calculated risk that he'll make it through that half-year wait without a major setback (ie "claim"). Given that he's already acknowledged his precarious (if not imminently threatened) heart health, this is either really gutsy, or really stupid.

And to be frank, I'm not sure which way I lean here.

I do respect that he at least touched base with the government agency overseeing the program. They were less than enthused that he might encourage others to follow his example, which I suppose is justified, but I think unfair. After all, it was the rocket surgeons who dreamed upthe train-wreck ObamneyCare© that insisted on making folks "go bare" for six months. What did they suppose was going to happen?

I have two particular problems with this strategy, both of which Mr D acknowledges: first, there's no guarantee that there'll be space for him once he's eligible; and second, the program has limited funding (and a sunset provision) that could leave him in the middle of a claim with no coverage.

Mr D's claim that he was uninsurable through the individual market gave me pause, so I reached out to California health insurance gurus David Fluker and our own Bill Halper. Turns out, this claim is likely valid; as Bill notes "any cardiac condition that requires ongoing treatment is pretty much death in the individual market." David expanded on this, explaining that "California individual health plans do not provide for any waivers, exclusions or riders. It’s all or nothing whatever the plan covers. As such our decline rates are much higher here and any condition of the heart is too risky for an insurer to cover."

Which is good to know.

The real problem, though, is the timing. As noted in the article, one must be uninsured for (at least) six months to be eligible. But (at least in California), one can't even apply for coverage prior to that six month "waiting period." David went above and beyond, and caught a disturbing flaw on Mr D's part:

"With the enrollment process for PCIP, a person would likely be uninsured 7-8 months by the time they were enrolled in PCIP, which is very risky for those with serious health conditions. PCIP enrolls 10th of the month for 1st of the following month and since you have to be uninsured 6 or more months before you apply, the 10th of month 7 is the earliest one can apply. If a person submits the application prior to the 6 months having elapsed, the app is deemed ineligible for PCIP and sent over to MRMIP.

It can be done but it’s a bit complicated."

Talk about understatement.

I've had more than one client (or potential client) in the same boat as Mr Dotinga, and I must admit that I am torn about what to advise. I am not comfortable telling folks they should "roll the dice," but the alternatives are difficult, as well.

On the other hand, there are any number of programs available to folks in his position to access health care for nominal or no cost. In fact, we've linked to some of these in the sidebar for many years. Of course, one must take the initiative and at least contact these folks, but help is available.

For now, anyway.

"I canceled my very expensive individual health insurance coverage through California's state-run high-risk plan and became insurance-free ... no one will insure me on the individual market ... I have made do with the state's high-risk insurance plan. California ... The federal high-risk plan would cost me just $265 a month"

It's hard not to feel some compassion for Randy Dotinga (Mr D): his health issues don't seem to be self-inflicted. But I have a number of issues with what he proposes. Of course, I completely respect his right to make this choice, even if ill-advised.

University of Chicago professor Harold Pollack nails it:

"[Randy's] responding in an understandable way ... Any program that requires people to be actively uninsured creates a very paradoxical and painful set of incentives and encourages people to do what you're doing."

As we've noted before, PCIP requirements are not only counter-intuitive, they actually punish folks who've played by the rules (as Mr D appears to have done). In this case, he's taking a calculated risk that he'll make it through that half-year wait without a major setback (ie "claim"). Given that he's already acknowledged his precarious (if not imminently threatened) heart health, this is either really gutsy, or really stupid.

And to be frank, I'm not sure which way I lean here.

I do respect that he at least touched base with the government agency overseeing the program. They were less than enthused that he might encourage others to follow his example, which I suppose is justified, but I think unfair. After all, it was the rocket surgeons who dreamed up

I have two particular problems with this strategy, both of which Mr D acknowledges: first, there's no guarantee that there'll be space for him once he's eligible; and second, the program has limited funding (and a sunset provision) that could leave him in the middle of a claim with no coverage.

Mr D's claim that he was uninsurable through the individual market gave me pause, so I reached out to California health insurance gurus David Fluker and our own Bill Halper. Turns out, this claim is likely valid; as Bill notes "any cardiac condition that requires ongoing treatment is pretty much death in the individual market." David expanded on this, explaining that "California individual health plans do not provide for any waivers, exclusions or riders. It’s all or nothing whatever the plan covers. As such our decline rates are much higher here and any condition of the heart is too risky for an insurer to cover."

Which is good to know.

The real problem, though, is the timing. As noted in the article, one must be uninsured for (at least) six months to be eligible. But (at least in California), one can't even apply for coverage prior to that six month "waiting period." David went above and beyond, and caught a disturbing flaw on Mr D's part:

"With the enrollment process for PCIP, a person would likely be uninsured 7-8 months by the time they were enrolled in PCIP, which is very risky for those with serious health conditions. PCIP enrolls 10th of the month for 1st of the following month and since you have to be uninsured 6 or more months before you apply, the 10th of month 7 is the earliest one can apply. If a person submits the application prior to the 6 months having elapsed, the app is deemed ineligible for PCIP and sent over to MRMIP.

It can be done but it’s a bit complicated."

Talk about understatement.

I've had more than one client (or potential client) in the same boat as Mr Dotinga, and I must admit that I am torn about what to advise. I am not comfortable telling folks they should "roll the dice," but the alternatives are difficult, as well.

On the other hand, there are any number of programs available to folks in his position to access health care for nominal or no cost. In fact, we've linked to some of these in the sidebar for many years. Of course, one must take the initiative and at least contact these folks, but help is available.

For now, anyway.

Will SCOTUS striking down ACA cause for reflection?

It amazes me how often I see comments like this from Jodi Kantor of the NY Times:

The article in whole is about SCOTUS striking down all or part of Obama's Affordable Care Act, something these same people said was impossible. To question the constitutionality of ACA was dismissed and ridiculed; yet here we are today widely expecting just that to happen.

When will people like Jodi realize they are idiots, the problem is not the aggressive courts or divisive politics? They just don't understand healthcare or the law and thus tend to get analysis wrong. Just as the ACA was always unconstitutional, Death Panels were always a legitimate concern, Jodi just isn't intelligent enough to understand why.

We can only hope that people like Jodi Kantor take some time after the court ruling and reflect on why, once again, they got it wrong and make the connection to their lack of talent. Jodi could have had a perfectly accurate article if she had left that partial sentence out, yet for some reason they always feel compelled to over reach and show just how little they know.

Saturday, June 23, 2012

This is What Happens

when uninformed Bozo's speculate on things about which they know absolutely nothing. Same can be said for lawyers that have never had a real job, or run a business, making laws without understanding the impact . . . or even bothering to read the law before passing it.

Serving as an elected official or college professor does not count as a real job if that is the only paycheck you have ever earned.

We should also include bloggers like Ezra Klein who hold themselves up as experts when in fact we have seen little proof that she knows what she is talking about.

Ezra has this to offer regarding her views on Obamacare and the individual mandate.

. It was hard to find a law professor in the country who took them seriously. “The argument about constitutionality is, if not frivolous, close to it,” Sanford Levinson, a University of Texas law-school professor

How many of those surveyed law professors have ever had a real job or worked in the health insurance field? How many of them truly understand the way health care, and health insurance, are indelibly intertwined and how health care drives health insurance premiums?

Orin Kerr, a George Washington University professor who had clerked for Justice Anthony Kennedy, said, “There is a less than one-per-cent chance that the courts will invalidate the individual mandate.”

Wonder how Jimmy the Greek would handicap Mr. Kerr's prediction?

Max Baucus, the chairman of the Senate Finance Committee, included an individual mandate in the first draft of his health-care bill. The main Democratic holdout was Senator Barack Obama.Of course now we know that Obama has changed his mind on the mandate, and so have a horde of politicians who were for the mandate before they were against it, or against the mandate before they were in favor of it.

Truth is, a politician is for or against something based not on sound judgement, or even principle, but rather on whether or not they want to be elected or re-elected.

They also have no clue how their legislation will impact the individuals or businesses until after the law is passed and implemented.

In principle, I am opposed to the mandate for many reasons, not the least of which is I believe government intrusion in almost every aspect of our lives is excessive. But if the mandate is upheld, it should apply only to catastrophic policies with deductibles that comply with Treasury rules for establishing an HSA. The policies should also be free of clutter by allowing them to bypass most state imposed mandates that add an average of 30% to the premiums.

Health insurance should be a Bozo free zone.

Friday, June 22, 2012

Health Wonk Review: SCOTUS on hold edition

FoIB and HWR founder Joe Paduda hosts this week's assortment of posts on health care policy and polity. As usual, it's chock full of interesting, sometimes provocative posts.

Do check it out.

Do check it out.

Cavalcade of Risk #160: Call for submissions

Next week's Cavalcade of Risk will be at Jay and Louise's place. Entries are due by Monday (the 25th).

To submit your risk-related post, just click here to email it.

You'll need to provide:

■ Your post's url and title

■ Your blog's url and name

■ Your name and email

■ A (brief) summary of the post

PLEASE remember: ONLY posts that relate to risk (not personal finance tips and the like).

Thanks!

Thursday, June 21, 2012

Propaganda Never Dies

Commenting on another blog I came across an all too familiar problem:

Ignoring the debatable opinion in the first paragraph, it is the highlighted part that is really the problem. Since HIPAA passed in 1996 small groups are not only guaranteed issued but the rates are capped meaning sick groups are subsidized by healthier groups. As Kaiser shows all 57 States have Guarantee issue up to 50 lives; the only variable is does it start at one or two. Husband and wife is two, so no matter what state she lives in they are guaranteed insurance.

Maybe this is Darwin's way to prevent people from starting businesses that shouldn't, but it is concerning that people with these misbeliefs are voting. If someone wants to start a business so badly but is stopped by a problem that doesn't exist to what measure will they go to solve this imaginary problem?

MLR vs SCOTUS: Under the radar

As we wait breathlessly for the SCOTUS decision on ObamneyCare©, I'll engage in some completely baseless (but fun) speculation. We've written extensively on the stupidity that is MLR (Medical Loss Ratio), and FoIB Holly R sent us this link on the latest:

"Health insurance plans owe $1.1 billion in rebates ... Millions of consumers and businesses will receive $1.1 billion in rebates this summer from health insurance plans that failed to meet a requirement of the new health-care law"

Thus sayeth HHS Secretary Shecantbeserious.

As an aside, do "professional journalists" and/or "editors" actually proofread the stuff they spit out? It would appear not, since they seem to be saying that Madame Secretary envisions checks totaling multiples of billions of dollars ("Millions of consumers" will be getting checks for "$1.1 billion"). On the other hand, given the current regime, maybe that's just the next Spendulus.

Compounding this idiocy is that Madame Secretary and her minions have no idea how many rebates will be "earned," let alone the total dollar value. I guess we'll have to send out the checks to see how many - and how much - they are.

But here's the piece that has me chuckling: the naysayers claim that if SCOTUS scuttles ObamneyCare©, “adult children” will be booted off parents’ insurance, policies will be rescinded willy-nilly, and other assorted clamors of doom.

So here's my question: in that scenario, wouldn't those who received MLR-generated rebates have to return them to the carrier(s)? And yes, I'm quite serious. Sauce for the goose, and all that.

"Health insurance plans owe $1.1 billion in rebates ... Millions of consumers and businesses will receive $1.1 billion in rebates this summer from health insurance plans that failed to meet a requirement of the new health-care law"

Thus sayeth HHS Secretary Shecantbeserious.

As an aside, do "professional journalists" and/or "editors" actually proofread the stuff they spit out? It would appear not, since they seem to be saying that Madame Secretary envisions checks totaling multiples of billions of dollars ("Millions of consumers" will be getting checks for "$1.1 billion"). On the other hand, given the current regime, maybe that's just the next Spendulus.

Compounding this idiocy is that Madame Secretary and her minions have no idea how many rebates will be "earned," let alone the total dollar value. I guess we'll have to send out the checks to see how many - and how much - they are.

But here's the piece that has me chuckling: the naysayers claim that if SCOTUS scuttles ObamneyCare©, “adult children” will be booted off parents’ insurance, policies will be rescinded willy-nilly, and other assorted clamors of doom.

So here's my question: in that scenario, wouldn't those who received MLR-generated rebates have to return them to the carrier(s)? And yes, I'm quite serious. Sauce for the goose, and all that.

The "Other" Mandate: Not Just for Catholics

While it might be tempting to write off objections to the mandating of coverage for convenience items birth control and abortion as a purely Catholic issue, it's really not:

"Many Protestant institutions are also trying to overturn the compromise that coerces private religious institutions to fund health insurers who can provide beneficiaries with abortion-inducing drugs"

Cans of worms....

"Many Protestant institutions are also trying to overturn the compromise that coerces private religious institutions to fund health insurers who can provide beneficiaries with abortion-inducing drugs"

Cans of worms....

Wednesday, June 20, 2012

So what?

FoIB Holly R tips us to this shocker from The Hill:

"More than 3 million young adults have been able to stay on their parents' insurance plans because of [ObamneyCare©]."

One of the provisions allows "adult children" (see also: "jumbo shrimp") to stay on their parents' health insurance plan until they're 27 (29 in Ohio). This is also a case of "bootstrapping:" ObamneyCare© did away with individual policies for actual children in favor of those who can actually fend for themselves.

Theoretically, anyway.

It's a fairly innocuous piece of thistrain wreck initiative, but it's also expensive for those who choose to take advantage of it: in most cases, the cost of the rider is far greater than an individual policy would be (particularly if the group plan is the typical co-pay arrangement).

But of course we can't expect The Hill to report on that.

"More than 3 million young adults have been able to stay on their parents' insurance plans because of [ObamneyCare©]."

One of the provisions allows "adult children" (see also: "jumbo shrimp") to stay on their parents' health insurance plan until they're 27 (29 in Ohio). This is also a case of "bootstrapping:" ObamneyCare© did away with individual policies for actual children in favor of those who can actually fend for themselves.

Theoretically, anyway.

It's a fairly innocuous piece of this

But of course we can't expect The Hill to report on that.

LTCi: Greater Need, Fewer Choices

Jim Reynolds runs Caring Companion Home Care in Concord, Massachusetts. The 20 year old company provides home health care services, and Mr Reynolds has a message for those of us who sell Long Term Care insurance (LTCi):

"You're doing a good job; keep at it."

That's the good news.

The bad news is that, according to the National Association for Home Care & Hospice, some "7.6 million Americans received formal home health care and related services with a total value of about $58 billion in 2007;" by now, that number is likely to have grown substantially. The problem, of course, is that this care isn't free, and Medicare pays only a part (if any at all).

That's where LTCi comes in:

"When asked during an interview about how many of the families can use LTCI coverage to pay for the care, he thinks a bit, then says the percentage might be "10% to 10%." Then he thinks a bit more and says, "Closer to 10 percent.... It's not near as high as it ought to be."

And therein lies the rub: just as we see the need for this kind of plan peaking, its availability is on the decline:

"Shopping for long-term-care insurance? You should expect higher costs and a tougher approval process as a growing number of household-name insurers quit selling the policies."

As Bob noted this spring, "Prudential has announced they will be withdrawing from the individual long term care market." Met and Unum had already bailed on the individual LTCi market, and other carriers are now tightening their belts.

Those carriers "toughing it out" are making significant changes (aka reductions) in their product offerings. The latest comes from MassMutual. Although it's unlikely that they'll completely exit this market anytime soon, they're making some pretty significant changes. From email I received this morning:

Indeed.

So what to do? Well, if you have a need for this kind of coverage, then you'd best be acting sooner rather than later in getting it.

[Hat Tip: MM's Jeff M]

"You're doing a good job; keep at it."

That's the good news.

The bad news is that, according to the National Association for Home Care & Hospice, some "7.6 million Americans received formal home health care and related services with a total value of about $58 billion in 2007;" by now, that number is likely to have grown substantially. The problem, of course, is that this care isn't free, and Medicare pays only a part (if any at all).

That's where LTCi comes in:

"When asked during an interview about how many of the families can use LTCI coverage to pay for the care, he thinks a bit, then says the percentage might be "10% to 10%." Then he thinks a bit more and says, "Closer to 10 percent.... It's not near as high as it ought to be."

And therein lies the rub: just as we see the need for this kind of plan peaking, its availability is on the decline:

"Shopping for long-term-care insurance? You should expect higher costs and a tougher approval process as a growing number of household-name insurers quit selling the policies."

As Bob noted this spring, "Prudential has announced they will be withdrawing from the individual long term care market." Met and Unum had already bailed on the individual LTCi market, and other carriers are now tightening their belts.

Those carriers "toughing it out" are making significant changes (aka reductions) in their product offerings. The latest comes from MassMutual. Although it's unlikely that they'll completely exit this market anytime soon, they're making some pretty significant changes. From email I received this morning:

"MassM announced ... that they are eliminating/limiting the following LTC options:Granted, these tend to be the more expensive, low-volume offerings, but they indicate that the carrier is taking the shrinking market very seriously. That is, when there are fewer carriers even offering LTCi, "no carrier wants to be out on an island offering riders/benefits no one else does because it attracts an inordinate amount of business and remaining in balance is critical to LTC success."

*Lifetime and 10-year benefit periods

*Full Return of Premium on Death and Return of Premium on Death riders

*All limited premium-payment options (10-year, paid-up at age 65 and discounted renewals

*Limiting the Shared Care rider to 2-3 year benefit periods

Indeed.

So what to do? Well, if you have a need for this kind of coverage, then you'd best be acting sooner rather than later in getting it.

[Hat Tip: MM's Jeff M]

Tuesday, June 19, 2012

MSM Plays Captain Obvious

From the "No Kidding, Sherlock" Department:

Wait, what??

Wasn't this train wreck "reform" going to guarantee that everyone would be insured while cutting premiums 3000 percent? Is the Associated Press, that well-known conservative mouthpiece, trying to tell us us it was all a big lie?

Hmmm.

Who, exactly, would still be uninsured among us?

Well, that would be "illegal immigrants and those who can't afford to pay out-of-pocket for health insurance."

Very interesting.

Why would illegals care about insurance in the first place? After all, they already get free care courtesy of the states. And of course, those who "can't afford" the premiums would be eligible for expanded Medicaid coverage and tax credits.

Sheesh.

[Hat Tip: FoIB Holly R]

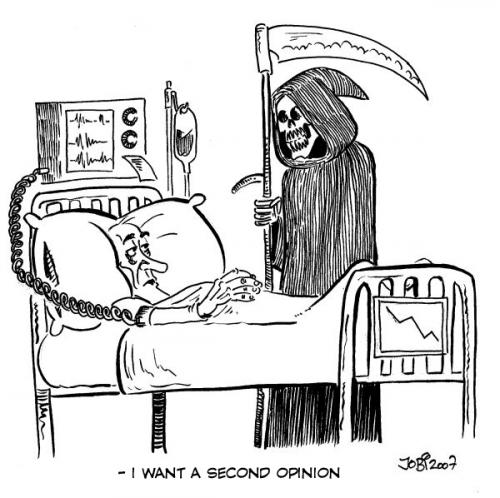

Death by MVNHS© [UPDATED]

Last time we looked, the Much Vaunted National Health System© was busy killing off 78 year old bladder cancer patient Kenneth Ward. Lest Mr Ward feel left out, here's news that he's far from alone:

This is nothing new, of course: last year, we noted that "[h]ip replacements, cataract surgery and tonsil removal are among operations now being rationed in a bid to save the NHS money." Still, these new numbers show why a single-payer system can never really sustain itself. As Bob mentioned last week, "true single payer eliminates private industry. The government decides how much to pay the provider and what services are expected. The British NHS works like this" and the fact that 90% of British hospitals engage in health care rationing of this magnitude simply underscore his point.

Defenders of single payer like to point out that they're more cost effective than a free-market model. Of course, it's easy to be cost-effective when providers "are denying treatment despite guidance from the National Institute for Health and Clinical Excellence that patients should receive it."

Meet the ultimate Death Panels.

UPDATE: Well, well, well - Thought we were exaggerating about those Death Panels? Think again:

"The NHS kills off 130,000 elderly patients every year ... NHS doctors are prematurely ending the lives of thousands of elderly hospital patients because they are difficult to manage or to free up beds ... Professor Patrick Pullicino said doctors had turned the use of a controversial ‘death pathway’ into the equivalent of euthanasia of the elderly."

But of course.

UPDATE: Well, well, well - Thought we were exaggerating about those Death Panels? Think again:

"The NHS kills off 130,000 elderly patients every year ... NHS doctors are prematurely ending the lives of thousands of elderly hospital patients because they are difficult to manage or to free up beds ... Professor Patrick Pullicino said doctors had turned the use of a controversial ‘death pathway’ into the equivalent of euthanasia of the elderly."

But of course.

Fewer Choices, Higher Costs: ObamneyCare©

Starting a new business is challenging enough, but navigating the maze of group insurance adds a whole new dimension. A frequent roadblock is the issue-and-participation requirement. This is a carrier rule based on the number of employees and how many opt for the group plan. Carriers justify this based on the concept of adverse selection (only sick people would sign up).

I recently met with the owners of a new company, and we quickly established that they'd be ineligible for a group plan based on participation requirements. Looking for alternatives, we wondered if a "stand-alone" Health Reimbursement Arrangement (HRA) would do the trick.

A stand-alone HRA is basically a health care debit card funded by the employer. A typical design might be $500 per year per employee; the first $500 of one's medical expenses would essentially be borne by the employer. Unlike a qualified Health Savings Account (HSA), there was no requirement for an underlying health insurance plan.

We thought this would be a great option in this case: it would mean that at least some of an employee's medical expenses could be shifted off his or her shoulders.

Alas, ObamneyCare© has ruled this out:

"Health care reform requires most group health plans to provide minimum annual levels of coverage for “essential health benefits” ... In 2014 group health plans will have to provide unlimited annual benefits for “essential health benefits” ... The government has ruled that most HRAs are considered group health plans for these purposes."

In other words, stand-alone plans would themselves have to be "unlimited," a rather daunting prospect for any business. Needless to say, this plan was a no-go.

So of course we can see how ObamneyCare© has increased choices and lowered costs across the board.

Or not.

[Hat Tip: FoIB Alissa C]

I recently met with the owners of a new company, and we quickly established that they'd be ineligible for a group plan based on participation requirements. Looking for alternatives, we wondered if a "stand-alone" Health Reimbursement Arrangement (HRA) would do the trick.

A stand-alone HRA is basically a health care debit card funded by the employer. A typical design might be $500 per year per employee; the first $500 of one's medical expenses would essentially be borne by the employer. Unlike a qualified Health Savings Account (HSA), there was no requirement for an underlying health insurance plan.

We thought this would be a great option in this case: it would mean that at least some of an employee's medical expenses could be shifted off his or her shoulders.

Alas, ObamneyCare© has ruled this out:

"Health care reform requires most group health plans to provide minimum annual levels of coverage for “essential health benefits” ... In 2014 group health plans will have to provide unlimited annual benefits for “essential health benefits” ... The government has ruled that most HRAs are considered group health plans for these purposes."

In other words, stand-alone plans would themselves have to be "unlimited," a rather daunting prospect for any business. Needless to say, this plan was a no-go.

So of course we can see how ObamneyCare© has increased choices and lowered costs across the board.

Or not.

[Hat Tip: FoIB Alissa C]

Monday, June 18, 2012

ObamneyCare© SCOTUS Meter... [UPDATED]

For those waiting with bated breath for a decision on the ObamneyCare© case, take a deep breath and relax (for the nonce):

Um....

UPDATE: Something to ponder while we're waiting. FoIB (and Cato Institute Director of Health Policy) Michael Cannon shares his thoughts on the latest ObameyCare© "bug:"

"Under the statute as written, if Congress fails to repeal IPAB [aka Death Panels] in 2017, then as of 2020 Congress will have absolutely zero ability to block or amend the laws that IPAB writes, and zero power to affect the Secretary’s implementation of those laws."

Michael, I'd observe that the folks behind thistrain wreck initiative would call that a feature, not a bug.

UPDATE: Something to ponder while we're waiting. FoIB (and Cato Institute Director of Health Policy) Michael Cannon shares his thoughts on the latest ObameyCare© "bug:"

"Under the statute as written, if Congress fails to repeal IPAB [aka Death Panels] in 2017, then as of 2020 Congress will have absolutely zero ability to block or amend the laws that IPAB writes, and zero power to affect the Secretary’s implementation of those laws."

Michael, I'd observe that the folks behind this

MVNHS© Customer Satisfaction takes a hit

As we've long noted, actual care delivery under the Much Vaunted National Health System© has been - at best - substandard. But don't just take our word for it:

"A new survey carried out by the King’s Fund health charity ... indicates that the general public’s levels of satisfaction with the running of the NHS have seen a marked drop. The number of people who were satisfied ... fell significantly to 58% in 2011."

Ooopsies.

MVNHS© leadership observed that these findings indicated that Brits are “worried and confused.” No kidding: they're worried because they see precisely how such systems fail to perform, and they're confused by the fact that it's still touted by the ruling class as terrific.

Regular readers already know thatvictims of participants in the MVNHS© can buy health insurance that can help pay for private care. The catch, which may be new to some, is that this service is available only to those on a waiting list.

Fortunately, this apparently comprises the majority of patients.

"A new survey carried out by the King’s Fund health charity ... indicates that the general public’s levels of satisfaction with the running of the NHS have seen a marked drop. The number of people who were satisfied ... fell significantly to 58% in 2011."

Ooopsies.

MVNHS© leadership observed that these findings indicated that Brits are “worried and confused.” No kidding: they're worried because they see precisely how such systems fail to perform, and they're confused by the fact that it's still touted by the ruling class as terrific.

Regular readers already know that

Fortunately, this apparently comprises the majority of patients.

Out of Focus

Consumer Reports will begin evaluating and grading doctors, perhaps in much the same way as they do appliances and automobiles. According to the folks at Amednews, this pilot project will start in Gov. Romney's home state of Massachusetts, then eventually to other states.

Consumer Reports will begin evaluating and grading doctors, perhaps in much the same way as they do appliances and automobiles. According to the folks at Amednews, this pilot project will start in Gov. Romney's home state of Massachusetts, then eventually to other states.Survey questions covered six general areas of the patient experience: communication; coordination of care; how well physicians get to know patients; the patient’s experience with office staff; whether the physician advised the patient on staying healthy; and pediatric care.

This is well and good but in most situations, the patient is ultimately responsible for their health. A patient that has a steady diet of cheeseburgers and Ding Dongs will never be healthy until they opt for a lifestyle change . . . something that is beyond the control of the physician.

“For me, what’s not addressed in this is the patient side of things,” he said. “Has the patient received the information and education they need, and are they doing what they were advised to do?”

A nation that is approaching a 50% obesity rate needs to invest in bathroom scales and a full length mirror. If your clothing size has an "X" on the label the problem is not your doctor.

"We have to change and we know that"

The Supreme Court decision on the Affordable Care Act is expected the week of June 25th, so the chatter is picking up again. Kaiser Health News has an interesting article here that includes this comment:

“We have to change and we know that,” said Ken Raske, president and CEO of the Greater New York Hospital Association, which represents 250 hospitals and medical care facilities. “But it’s easier if you’re going to build the building to have the shovels and picks and the hammer and nails than trying to dig it out with your hands. That’s what the Affordable Health Care Act is.”

I think this suggests an attitude within the hospital industry that is worth thinking about. Although Raske concedes hospitals have a business imperative to change, he warns they might have to slow down, unless government provides “shovels and picks and the hammer and nails”. Since the Federales cannot supply these literal tools to the hospital industry I think it’s clear Raske is talking about money.

The attitude is that, unless the government pays for change, change will be slow or nonexistent. I just don’t accept that attitude. Do you?

When other, non-hospital businesses have to change and they know it, what do they do? Do they rely on their own resources? Or do they rely first on getting government money - and tell their customers that they might not change – or might change slowly – if they don’t get it? You know the answer.

Short version of the above - News flash: the hospital industry says it must have more money from the government or it might slow down efforts to serve its patients better.

Health & Chocolate Down Under

"[R]esearchers at Monash University have discovered that eating a 100g [about 3.5 oz] bar of dark chocolate a day (yes, the whole seductive, delicious, mouthwatering brown slab, from each melting cube to the last sticky crumb) is one way to avoid cardiovascular disease."This magic elixir apparently reduces both blood pressure and cholesterol. Obviously, one must avoid over-consumption, but it sounds like a great way to eat healthy.

Subscribe to:

Posts (Atom)